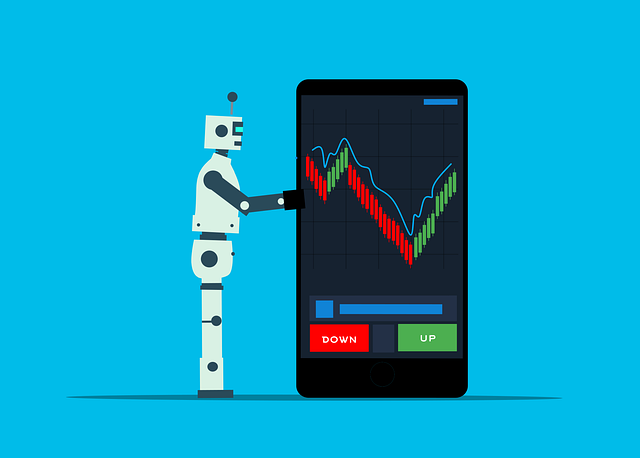

Robot trading (algorithmic trading) is revolutionizing Australia's financial landscape by using AI algorithms to automate investment decisions and enhance wealth creation through swift analysis of vast datasets. This technology promises higher profitability, risk reduction, and accessibility to sophisticated trading strategies, but requires addressing regulatory compliance and cybersecurity risks. Embracing robot trading is a significant step towards new levels of wealth generation in Australia.

In the dynamic landscape of Australian finance, robot trading is revolutionizing traditional investing models. This cutting-edge approach leverages artificial intelligence (AI) to optimize strategies, offering unprecedented access to wealth for investors of all levels. By automating time-consuming tasks and leveraging advanced algorithms, robot traders are transforming market dynamics, enabling more efficient and profitable outcomes. Discover how AI-driven investing is democratizing financial success in Australia, unlocking new opportunities for both seasoned professionals and aspirational investors alike.

- Robot Trading: A New Paradigm in Australia

- Traditional Investing Models Meet AI

- Wealth Within Reach: Automating Strategies

- Australian Market Dynamics Transformed

- Future of Finance: AI-Driven Investing

Robot Trading: A New Paradigm in Australia

Robot trading, also known as algorithmic trading, is reshaping the Australian financial landscape and introducing a new paradigm for investors seeking wealth within. This innovative approach leverages advanced computer programs to execute trades with speed and precision, often based on pre-programmed rules or real-time data analysis. In Australia, where traditional investing models have long dominated, robot trading offers both opportunities and challenges.

For investors, the allure lies in its potential for higher profitability and reduced risk through automation. These robotic traders can process vast amounts of market data in seconds, enabling them to identify and capitalize on opportunities that humans might miss. However, navigating this new frontier requires careful consideration of regulatory environments and ensuring robust security measures to protect against potential cyber threats. As Australia’s financial sector continues to evolve, embracing robot trading could be a key step towards unlocking new levels of wealth within the market.

Traditional Investing Models Meet AI

In Australia, traditional investing models are undergoing a significant evolution with the advent of artificial intelligence (AI). The integration of AI algorithms is transforming how investors manage their portfolios, offering a new frontier in wealth creation and preservation. These advanced systems can analyze vast amounts of data, identify patterns, and make trading decisions at speeds unattainable by human brokers. This technological advancement promises to optimize investment strategies, enhance risk management, and potentially increase returns for savvy Australian investors.

By leveraging machine learning and natural language processing, robots are now capable of understanding market nuances and adapting to dynamic conditions. They can process global news, social media sentiment, and economic indicators in real time, allowing for split-second responses to market shifts. As a result, traditional models are being refined, incorporating AI’s ability to uncover hidden opportunities within complex data sets—a capability that was once the preserve of human experts. This marriage of human expertise and artificial intelligence is set to redefine Australia’s investment landscape, making wealth management more efficient, accessible, and potentially lucrative for all participants.

Wealth Within Reach: Automating Strategies

In the dynamic landscape of Australian investing, robot trading is democratizing access to wealth. By automating investment strategies, sophisticated algorithms now manage portfolios with precision and speed, making high-quality investing accessible to a broader range of individuals. This technological shift allows investors to leverage complex models that analyze vast amounts of data in real time, identifying opportunities and executing trades swiftly.

With robot trading, wealth becomes more than just a dream—it’s within reach. These automated systems eliminate the need for constant monitoring and manual intervention, enabling investors to focus on their goals while the robots handle the intricate details. As a result, individuals can participate in the market with confidence, knowing that their investments are guided by intelligent, data-driven strategies designed to maximize returns over time.

Australian Market Dynamics Transformed

The Australian market has witnessed a significant shift in dynamics with the advent of robot trading, or algorithmic trading as it’s often called. This innovative approach leverages advanced algorithms and artificial intelligence to execute trades at speeds unattainable by human traders. The result is a more efficient, data-driven investment landscape where patterns are identified and decisions are made in fractions of seconds. This transformation is not just about speed; it’s about uncovering hidden opportunities within complex market data, potentially leading to substantial wealth generation for investors.

In this new era, traditional investing models are being reevaluated and often enhanced by the power of automation. Australian investors now have access to sophisticated trading robots that can navigate the intricate web of financial markets with remarkable accuracy. By analysing vast amounts of historical and real-time data, these robots identify trends and make informed decisions, ensuring investors stay ahead of the curve. This shift towards robot trading promises to revolutionise wealth creation within Australia’s financial sector.

Future of Finance: AI-Driven Investing

The future of finance is here, and it’s driven by artificial intelligence (AI). In Australia, robot trading is revolutionizing traditional investing models, promising to optimize portfolio management and maximize returns for investors. AI-powered algorithms can analyse vast amounts of data in real-time, identifying patterns and opportunities that human traders might miss. This technology enables more informed decision-making, adapting swiftly to market changes and ensuring investors stay ahead of the curve.

By leveraging wealth within existing financial systems, robot trading offers a game-changing approach to investing. It fosters a dynamic and efficient market, where automation enhances transparency and accessibility. With AI at the helm, the potential for wealth creation becomes more democratized, providing individuals with advanced tools to navigate the complexities of global markets and secure their financial future.

The integration of robot trading and AI into traditional investing models in Australia has democratized access to wealth, revolutionizing market dynamics with automated strategies. As the financial landscape continues to evolve, AI-driven investing is poised to become the norm, offering greater efficiency, precision, and opportunity for all investors. By leveraging advanced algorithms and data analytics, the future of finance looks set to be more inclusive and prosperous for folks across the land down under and beyond.