Robot trading (algorithmic trading) is revolutionizing Australia's investment sector by automating trade execution, processing vast data swiftly, and reducing errors. This technology offers investors a competitive edge through rapid decision-making and predefined rules. With AI integration, robot trading enhances efficiency, pattern recognition, and contextually aware strategies, promising to democratize access to advanced trading methods in Australia.

In today’s digital era, robot trading is revolutionizing investment strategies globally, and Australia is no exception. This article explores how automated systems enhance market efficiency and offer unprecedented advantages to local investors. We delve into the world of robot trading, highlighting its impact on speed, accuracy, and collaboration between humans and AI. By understanding these trends, investors can navigate the future of trading, where artificial intelligence integration promises to transform investment landscapes.

- Robot Trading: Efficient Investment Revolution

- Enhancing Australian Markets with Automation

- Strategies: Human-Robot Collaboration Benefits

- Speed and Accuracy: Robot's Key Advantages

- The Future of Trading: AI Integration Insights

Robot Trading: Efficient Investment Revolution

Robot trading, also known as algorithmic trading, has emerged as a game-changer in the Australian investment landscape. This innovative approach leverages advanced computer programs to execute trades with speed and precision, enhancing efficiency across various markets. By employing complex algorithms, robot traders can process vast amounts of data in mere seconds, allowing for swift decision-making.

This technology enables investors to navigate the dynamic market environment with greater agility. Robot trading systems can identify patterns and trends that human analysts might miss, ensuring strategic investment choices. With its ability to automate repetitive tasks, reduce human error, and execute trades based on predefined rules, robot trading revolutionises traditional investment strategies, making it an attractive option for Australian investors seeking to stay ahead in a competitive market.

Enhancing Australian Markets with Automation

Australian markets, known for their dynamism and innovation, are witnessing a significant evolution with the integration of robot trading. This advanced technology is revolutionising investment strategies by automating processes that were once manual and time-consuming. With high-frequency trading robots, investors can execute trades at speeds unimaginable just a few years ago, giving them a competitive edge in the fast-paced financial landscape.

The benefits are numerous: improved execution times, reduced costs, and enhanced decision-making capabilities. Robot trading systems analyse vast amounts of data in real-time, identifying profitable opportunities and executing trades accordingly. This automation not only increases efficiency but also minimises human error, ensuring Australian investors can stay ahead in a constantly evolving market environment.

Strategies: Human-Robot Collaboration Benefits

In the dynamic world of Australian investments, the integration of robot trading has paved the way for innovative strategies, particularly when combined with human expertise. Human-robot collaboration offers a unique advantage by blending the analytical prowess of artificial intelligence with the intuitive judgment and experience of human investors. This partnership can lead to more effective decision-making processes, allowing for rapid responses to market fluctuations.

By leveraging robot trading, investment teams can automate repetitive tasks, freeing up time for humans to focus on complex analysis and strategic planning. Human oversight ensures that algorithms adhere to ethical guidelines and risk management principles, while robots enhance speed and accuracy in executing trades. This symbiotic relationship between technology and human skill significantly boosts overall efficiency, providing Australian investors with a competitive edge in the global market.

Speed and Accuracy: Robot's Key Advantages

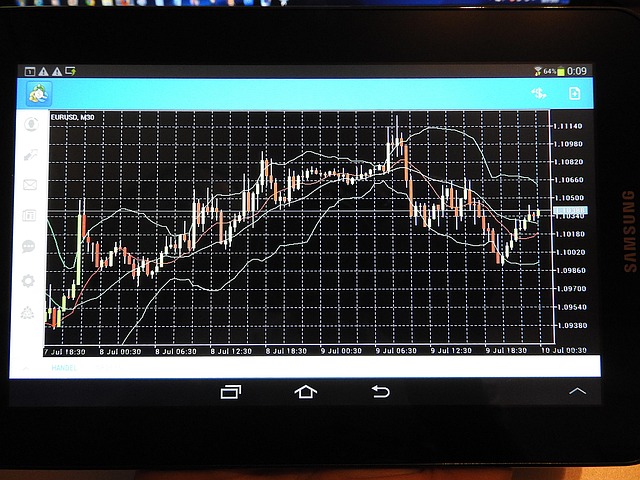

Robot trading, or algorithmic trading, has emerged as a game-changer in the Australian investment landscape. One of its most significant advantages lies in its unparalleled speed and accuracy. These automated systems can process vast amounts of market data in milliseconds, enabling investors to execute trades at lightning speed. This rapid response capability is crucial in today’s fast-paced financial markets, where even a fraction of a second can make a substantial difference in trade outcomes.

Moreover, robots are designed to follow pre-programmed rules and strategies with meticulous precision. They eliminate human errors and emotional biases that often influence traditional trading. The accuracy and consistency of robot trading ensure that investment decisions are based solely on predefined parameters and market data analysis, leading to more efficient and profitable trading strategies for Australian investors.

The Future of Trading: AI Integration Insights

The future of trading lies in the seamless integration of artificial intelligence (AI) and machine learning algorithms, a trend that is already reshaping the Australian investment landscape. Robot trading, powered by AI, offers unprecedented efficiency gains by processing vast amounts of data at lightning speed, identifying patterns, and making informed decisions with minimal human intervention. This technological advancement promises to democratize access to sophisticated trading strategies, enabling both institutional investors and individual traders to compete in a highly efficient market.

As AI continues to evolve, the capabilities of robot trading will become even more sophisticated. Advanced natural language processing (NLP) can analyze news articles and social media feeds to extract relevant information that influences markets. Computer vision algorithms can interpret complex financial charts and graphs with remarkable accuracy. These developments suggest a future where trading strategies are not only data-driven but also contextually aware, providing an edge in the dynamic Australian investment environment.

Robot trading is transforming Australian investment strategies, offering unprecedented efficiency gains through speed, accuracy, and data-driven decisions. By automating tasks, combining human expertise with robotic precision, investors can navigate markets with enhanced agility. As AI integration deepens, the future of trading promises even more sophisticated collaboration between humans and robots, reshaping the landscape of Australian investment with remarkable effectiveness.